General purpose financial statements definition

/What are General Purpose Financial Statements?

General purpose financial statements are those financial statements released to a broad group of users. They are intended for a wide range of uses, such as credit analysis and stock valuations. These statements include the following:

-

Income statement . This report shows the revenues, expenses, and profit or loss of a business over a specific period of time.

-

Balance sheet . This report summarizes the assets, liabilities, and equity of a business as of the report date.

-

Statement of cash flows . This report summarizes the sources and uses of cash for a business over a specific period of time.

-

Statement of shareholders’ equity . This report summarizes any changes in an organization’s equity balances over a specific period of time, including dividend payments, the purchase or sale of shares, and changes in net income.

If the financial statements have been audited, then they should also include the audit report .

More specific financial statements may also be released; these are not considered to be "general purpose." For example, the management team may want to see detailed departmental expense reports, while a condensed version of the income statement may be acceptable for credit reviews by suppliers . Other users may not require a complete set of the financial statements, perhaps requesting just the income statement. These statements are usually subsets of the general purpose statements, or they compress or expand the presentation of information.

Example of General Purpose Financial Statements

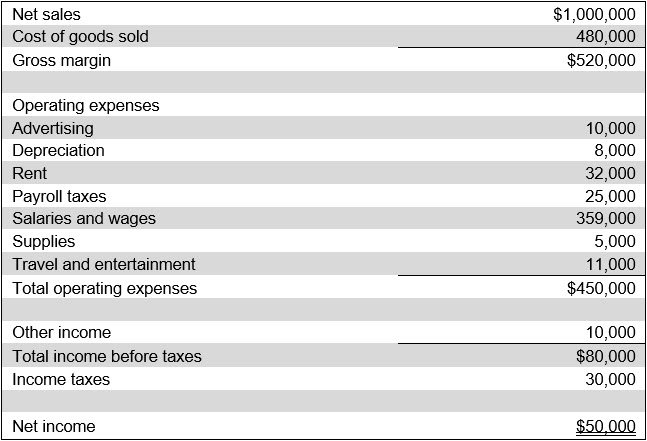

An example of an organization’s income statement appears in the following exhibit, where the cost of goods sold is subtracted from net sales to arrive at the gross margin, after which operating expenses and taxes are subtracted to arrive at a net income figure.

An example of an organization’s balance sheet appears in the following exhibit, where assets are listed first, followed by liabilities, and finally all equity line items. The sum of all liabilities and equity always equals the total of all assets presented.

An example of an organization’s statement of cash flows appears in the following exhibit, where all cash flows from operating activities are listed first, followed by cash flows from investing activities, and then cash flows from financing activities.

Who Receives General Purpose Financial Statements?

General purpose financial statements are usually issued to the investment community and lenders . These statements are used to discern the financial condition and results of the issuing entity. The frequency of distribution of these statements can vary, depending on the demands of users. For example, a publicly-held company will issue general purpose statements once a quarter, while a lender might demand monthly statements, and a government might accept just annual statements.