Document Type

Poster

Publication Date

Fall 10-6-2023

Abstract

Stock price prediction plays a vital role in financial decision-making and has been an area of extensive research. In this research, we explore the effectiveness of the differential equation of Brownian motion as a method for stock price prediction and compare its performance with two established techniques, ARIMA and XGBoost. Using historical data from Yahoo Finance, we assess the predictive capabilities of these models and analyze their strengths and weaknesses. The findings of this study will shed light on the potential of Brownian motion as a viable approach in financial forecasting and provide valuable insights for investors and researchers in applying mathematics in social sciences. We also researched the application of this technique in option pricing and combined this with more complicated mathematical models.

Recommended Citation

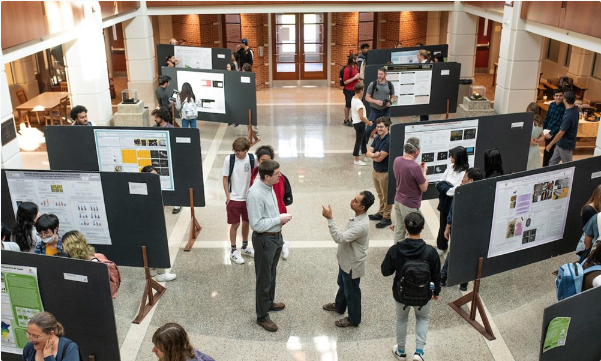

Le, Alan Tuan; Le, Mai; and Charoenphon, Sutthirut, "Differential Equations in Stock Prediction Analysis" (2023). Annual Student Research Poster Session

. 134, Scholarly and Creative Work from DePauw University.

https://scholarship.depauw.edu/srfposters/134

Comments

Funding provided by the J. William Asher and Melanie J. Norton Endowed Fund in the Sciences